CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

SECURITIES MARKET

MARKET AND FINANCIAL HIGHLIGHTS

The FBM KLCI hit an all-time high of 1,892.65 points on 8 July 2014 but moderated to close the year at

1,761.25 points, 5.7% lower than the preceding year end’s 1,866.96 points.

SECURITIES TRADING MAINTAINS MOMENTUM

The Securities Market continued its upward trend, reporting a profit contribution increase of 15% to RM294.3

million from RM256.8 million in 2013. Total operating revenue rose 9% to RM368.1 million from RM338.8

million in 2013.

Trading revenue continued to grow, increasing 10% to RM239.1 million from RM217.3 million in 2013 as

a result of higher ADV for on-market trades (OMT) of RM2.1 billion from RM1.9 billion in 2013. Domestic

participation ADV for OMT grew 11% to RM1.6 billion in 2014 from RM1.4 billion in 2013, while foreign

participation ADV for OMT declined 3% to RM0.5 billion in 2014.

Other factors contributing to the upward trend of the Securities Market include the higher number of corporate

exercises as well as a higher number of structured warrants listings. The Market Data segment also posted

higher revenues of RM24.0 million, up 24% from RM19.3 million in 2013, contributing to the overall growth

in Securities Market revenue. Growth in the Market Data segment is attributed to the introduction of new

information packages such as non-display usage data and corporate announcements.

RETAIL INVESTORS KEY DRIVERS OF GROWTH

Improvements in the Securities Market trading revenue contributions were mainly driven by higher ADV for

OMT of RM2.05 billion, up 7% from RM1.92 billion in 2013, as well as higher effective clearing fee rate.

We saw an increase in market activity by retail investors due primarily to global uncertainties, which spurred

active trading. The greater retail investors participation was achieved through our constant outreach activities

over the last few years. In 2014, retail participation in the Securities Market rose 4 percentage points to

represent 26% of total activity (from 22% in 2013).

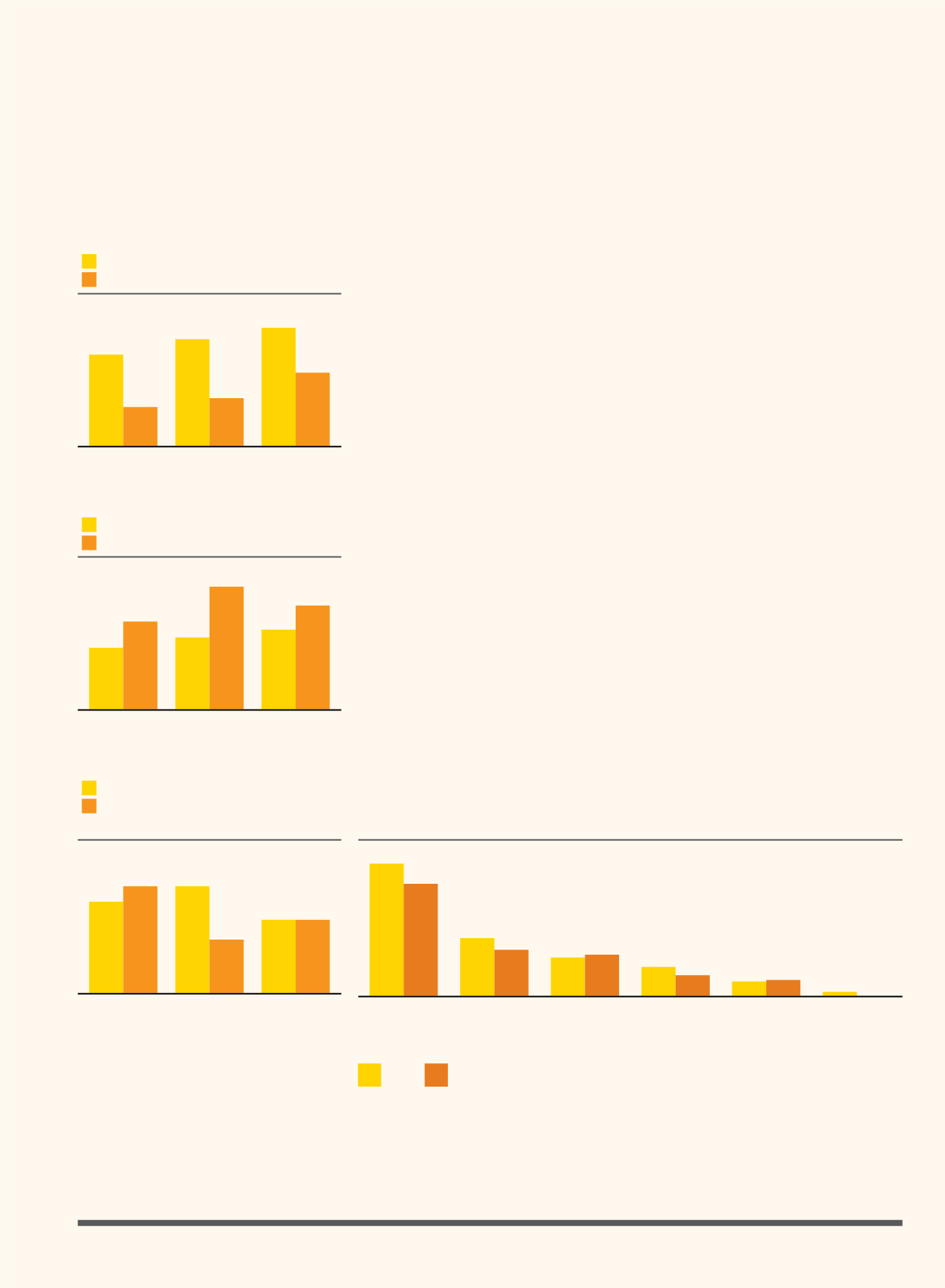

OPERATING REVENUE

(RM million)

Trading Revenue Listing and

Issuer Services

Depository

Services

Market Data

Member

Services and

Connectivity

Conference

Income

239.1

55.8

35.4

24.0

13.6

0.2

217.3

51.1

37.1

19.3

14.0

-

2014

2013

SEGMENT PROFIT AND OPERATING MARGIN

Segment Profit (RM million)

Operating Margin (%)

ADV AND FBM KLCI

ADV (RM billion)

FBM KLCI

NO. OF NEW LISTINGS AND FUNDS RAISED

No. of New Listings

Funds Raised for IPOs & Secondary

Market (RM billion)

2012

2013

2014

2012

2013

2014

2012

2013

2014

294.3

2.2

14

256.8

2.1

18

223.3

1.7

17

77.3

24.3

73.6

22.5

72.9

1,688.95

1,866.96

1,761.25

31.7

FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

33