FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

31

CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

ENHANCING OUR MARKET STRUCTURE

We are constantly looking at ways to develop our market structure to secure

long-term sustainability. One of our core initiatives designed to enhance our

market structure is the implementation of ASEAN Post Trade services. We are the

first exchange participating in the ASEAN Trading Link to implement the service

and we believe that it represents an important value add for our market traders.

We have also taken steps to ease access to our markets by streamlining entry

requirements through policy changes such as the revamp in the derivatives

market participantship structure. These measures are in line with our overall

drive to make us a more efficient and effective market.

MAINTAINING A FAIR, ORDERLY AND EFFICIENT MARKET

Bursa Malaysia has a regulatory duty to uphold market integrity by ensuring a

fair, orderly and efficient market. To this end, we are continuously looking at new

developments in best practices for markets and to champion these practices to

our PLCs.

Our efforts in this area have helped propel the overall level of corporate

governance (CG) in Malaysian PLCs - an improvement that has been recognised

by international CG watchdogs.

TRANSFORMING INTO A HPO

We took another step forward in 2014 towards transforming Bursa Malaysia

into a HPO. Talent recruitment and management reform remain key enablers

of this transformation and we have continued to drive the development of our

talent bench by implementing aggressive employee recruitment and retention

strategies.

We have bolstered our capabilities in line with our demand for higher standards

of governance, and we continued the process of institutionalising the new

performance benchmarks into our corporate culture.

To support our journey towards becoming a HPO organisation, our Group Human

Resources (GHR) has instituted a number of talent management programmes

designed to secure our long-term sustainability and meet our future talent

requirements.

BEST PERFORMANCE SINCE 2008

Our financial performance in 2014 is the best since 2008 and is trending in

the right direction. Bursa Malaysia posted a record profit after tax and minority

interest (PATAMI) of RM198.2 million (+15% y-o-y), an improved cost-to-income

ratio of 46.1% (-2 percentage points y-o-y) and a higher return on equity (ROE)

of 25.4% (+5 percentage points y-o-y). Financial performance for the year under

review was driven by higher trade volumes in all three of our markets due to

higher domestic participation.

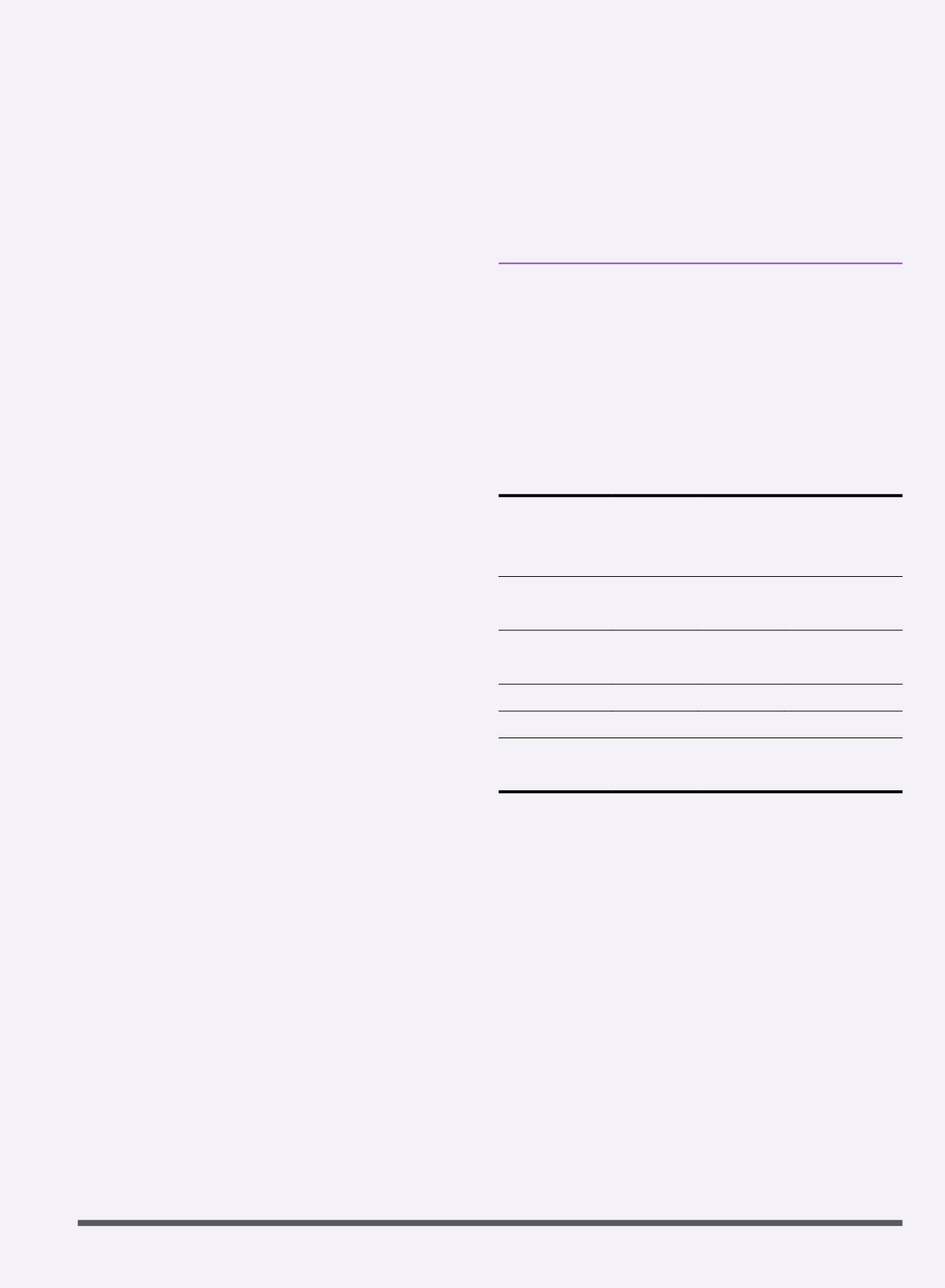

FINANCIAL HIGHLIGHTS

2014

2013

Financial Results

RM million RM million

% change

Operating Revenue

471.3

439.8

+7%

Other Income

32.5

35.2

-8%

Operating Expenses

(232.0)

(229.4)

+1%

Profit Before Tax

271.8

245.6

+11%

Income Tax Expense

(67.8)

(66.2)

+2%

Profit After Tax

204.0

179.4

+14%

Minority Interest

(5.8)

(6.3)

-8%

PATAMI

198.2

173.1

+15%

Financial Ratios

Cost to Income Ratio

46.1%

48.3% 2 percentage points

Return on Equity

25.4%

20.7% 5 percentage points

7% GROWTH IN OPERATING REVENUE

Operating revenue rose to RM471.3 million in 2014 from RM439.8 million in

2013, which represents a growth of 7%. Apart from higher trading revenue

from all three markets, the greater number of new structured warrant listings

and secondary issues in 2014 also improved revenue growth.

Revenue from our securities trading activities rose 10% to RM239.1 million in

2014 from RM217.3 million in 2013. Revenue growth was supported by higher

domestic participation, particularly in the retail segment.

Our Derivatives Market saw a marginal increase in trading revenue of RM70.6

million from RM70.3 million in 2013. Although volume traded showed a healthy

16% increase, lower guarantee and collateral management fees offset the

increase.