FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

32

CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

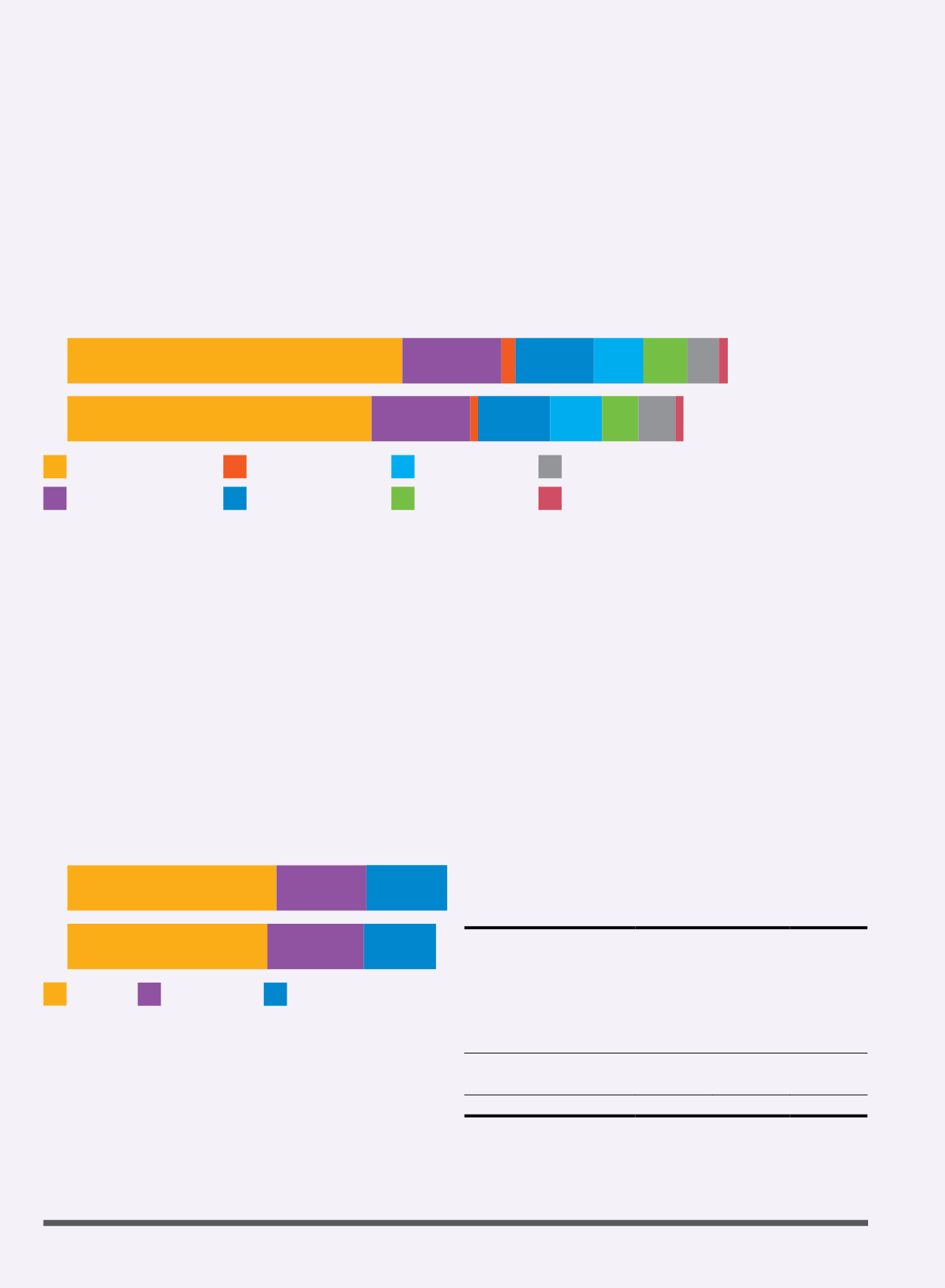

2013 2014

2013 2014

127.6

120.0

55.1

61.2

49.3

48.2

217.3

70.3 5.8 51.3

37.1 26.0 26.4

5.6

239.1

70.6 10.0 55.9

35.4 31.3 22.7

6.3

Securities Trading Revenue

Derivatives Trading Revenue

Manpower

Depository Services

Market Data

BSAS Trading Revenue

Listing & Issuer Services

Technology Costs

Member Services & Connectivity

Other Operating Revenue

Meanwhile, Bursa Suq Al-Sila’ (BSAS) trading continued its upward trend with revenue growing by 72% to RM10.0 million in 2014. The continuous revenue

growth in BSAS trading over the last few years is a positive indication of the growing acceptance of BSAS by domestic banks and sukuk issuers, which bodes

well for us as our strategy calls for us to leverage on Malaysia's status as a leading Islamic capital market.

OPERATING EXPENSE STABILISED;

TECHNOLOGY INVESTMENT YIELDING SAVINGS

Total operating expenses grew by 1% to RM232.0 million in 2014 compared

to RM229.4 million in 2013. Our expenses for the year continued to focus on

talent building and development to support our vision of transforming into a

HPO. Staff costs rose 6% to RM127.6 million in 2014 from RM120.0 million

in 2013.

Other operating expenses, which include marketing and development,

professional fees and administrative expenses, continued to grow as we

expanded our capabilities and our reach into the region. However, the overall

growth in our operating expenses was offset by lower depreciation costs as we

had successfully replaced our previous trading system with a higher capacity

but more cost efficient Bursa Trade Securities 2 (BTS 2).

Other Costs

REWARDING OUR SHAREHOLDERS

Bursa Malaysia’s Board of Directors has recommended a final dividend of

18 sen subject to shareholders’ approval at our Annual General Meeting to be

held in March 2015. If approved, the total dividend paid by Bursa Malaysia in

2014 will amount to 54 sen per share, which includes a 20 sen special dividend

and a 16 sen interim dividend paid in August 2014. The total dividend paid of

RM288.1 million represents a 6.7% dividend yield.

SEGMENTAL PERFORMANCE

The Securities Market, as well as the Islamic and Alternative Markets (IAM),

continued to make good progress, while the Derivatives Market was affected

by lower guarantee and collateral management fees earned. Exchange

Holding was affected by lower broker services from the rationalisation effort

undertaken by Bursa Malaysia to enable brokers to use their own network,

and lower interest income earned subsequent to the distribution of a special

dividend in 2013 and 2014 respectively.

2014

2013

Segmental Review

RM million RM million % change

Segmental Profit/(Loss) From:

Securities Market

294.3

256.8

+15%

Derivatives Market

40.8

44.1

-7%

Islamic & Alternative Markets

5.4

0.9

+500%

Exchange Holding

(8.9)

3.1

-387%

Total Segmental Profit

331.6

304.9

+9%

Overheads

(59.8)

(59.3)

+1%

Profit Before Tax

271.8

245.6

+11%

OPERATING REVENUE (RM million)

OPERATING EXPENSES (RM million)