FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

41

MOVING FORWARD

OUTLOOK OPTIMISTIC DESPITE CHALLENGING 2015

2015 is shaping up to be another challenging year as global markets have

remained volatile. We believe that we will continue to see challenges in the form

of pressure on commodity prices and volatility in currency prices. However, we

remain confident that the initiatives that we have undertaken and planned will

enable us to sustain the momentum we have created for ourselves.

Upward-trending PATAMI and operating revenue coupled with managed

operating expenses over the past six years are evidence that the building blocks

and processes we have put in place have served us well despite challenging

operating conditions. With strong fundamentals in place, we believe that we will

be able to face 2015 with similarly optimistic expectations.

Aside from the global economy, we also face challenges in the form of greater

competition from other exchanges in the region and in navigating changing

regulatory requirements. However, we believe that Malaysia’s track record of

being a resilient market due to its strength in investor protection and robust

corporate governance framework will continue to be a draw for investors, hence

supporting the growth agenda whilst maintaining market confidence and integrity.

CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

TAKING THE NEXT STEP IN REALISING SHAREHOLDER VALUE

We take continuous steps to transform our latent potential into value for our

stakeholders. This can be seen from our healthy dividend yield of 6.7% in 2014 and

other key financial ratios. Our return to shareholders has been trending in the right

direction since 2008. Return on Equity improved to 25.4% in 2014 from 20.7% in

2013.

The additional resources we have put in place over the last few years which

include human capital and infrastructure development, and the streamlining of

processes, will continue to enhance our returns as an exchange operator to our

shareholders, as we keep our focus trained on our role as a market regulator.

We are confident that we have most of the components in place necessary for us

to become ASEAN’s Multinational Marketplace, and it is now a matter of reaching

out to the investing community to determine how we can best serve their needs.

At the same time, we are aware that Bursa Malaysia plays a unique role in serving

as a benchmark for other PLCs. Indeed, our theme for action in 2015 is “Open

Skies, Driving Sustainability”, which puts governance and sustainability within a

newly integrated AEC at the centre of our activities.

APPRECIATION

Over the last few years, we have worked hard to transform Bursa Malaysia into

an entity that is capable of competing with leading exchanges in the region, but

our work is not yet complete. Now is the time for us to show that we are not an

exchange with mere potential, but an exchange capable of delivering value to all

stakeholders, from our shareholders to the general public.

On behalf of Bursa Malaysia’s management, I would like to express our thanks

and appreciation to all our stakeholders who have worked hard together with us

to put the Exchange in our current enviable position. I would like to make special

mention of appreciation to the staff of Bursa Malaysia without whom our plans

would have remained just that: plans. Execution is everything, and I believe that

the progress we have made over the past few years is testament to the success

of their execution.

Nonetheless, I would like to take this opportunity to remind all of us that the

hard work has only just begun. The challenges we will face in the new ASEAN

landscape will be unlike anything that we have experienced before, and there will

be difficult obstacles ahead of us. But with challenges come opportunity, and I

relish the opportunities that will doubtless be presented to us.

I am hopeful that we will continue to enjoy the support of our many stakeholders

even as we chart our way through this heretofore new territory and I look forward

to the years to come.

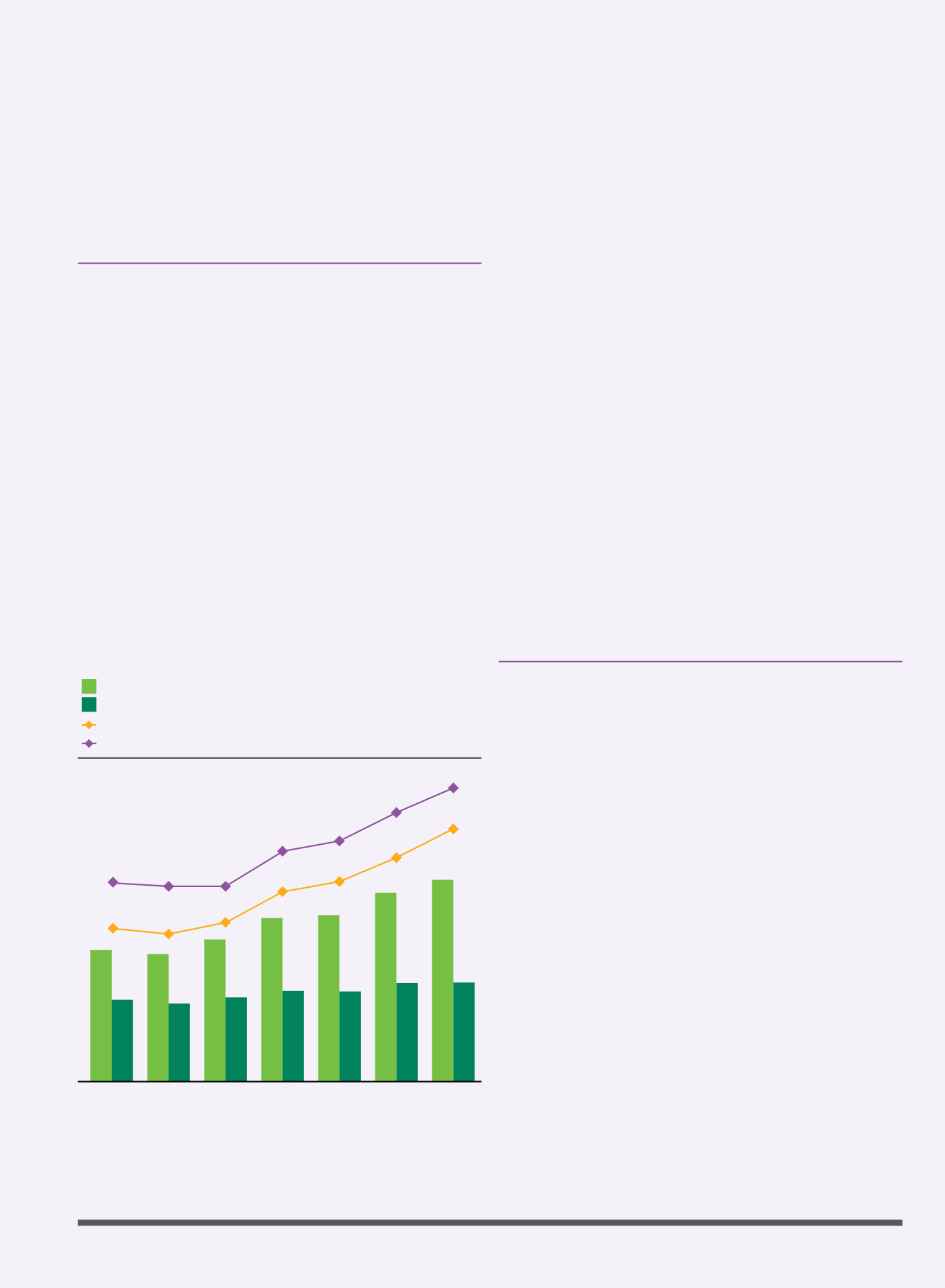

GROWING REVENUE AND PROFITS; MANAGED EXPENSES

Operating Revenue (RM million)

Operating Expenses (RM million)

PATAMI (RM million)

ROE

2008 2009*

2010 2011 2012 2013 2014

98.6

13

104.4

14

111.9

13

143.1

17

150.6

18

173.1

21

198.2

25

388.5

209.2

439.8

229.4

471.3

232.0

381.5

212.0

331.3

196.6

302.5

184.2

297.8

181.9

* PATAMI for 2009 excludes the gain on disposal of a subsidiary.