Bursa Malaysia • Annual Report 2013

29

A Sustainable Marketplace

Malaysia is today experiencing a revitalisation of

investment and this is expected to increase. The

Government Transformation Programme (GTP)

and Economic Transformation Programme (ETP)

continue to generate a robust investment pipeline,

fuel domestic demand growth and create an

even more conducive business environment for

Malaysian PLCs to grow.

Domestic demand is also expected to thrive

until 2020 on the back of consumer spending by

Malaysian baby boomers born between 1979 and

1989. Malaysia will have one of the fastest-growing

working populations in the world between now and

2020. To add, Malaysia’s savings rate is amongst

the highest in the world and we have a sustainable

pool of capital to fund domestic growth.

By instilling strong corporate governance

measures, developing innovative product and

service offerings, as well as fostering a healthy

IPO pipeline, among a throng of other initiatives,

Bursa Malaysia is complementing efforts to ensure

a robust and sustainable Malaysian marketplace.

We believe that as the developments within ASEAN

and our marketplace unfold, Bursa Malaysia’s

position as a diverse and sustainable multinational

marketplace will strengthen.

Our good performance in 2013 is certainly helping

to reinforce our standing as a relevant, innovative

and attractive “market on the move”.

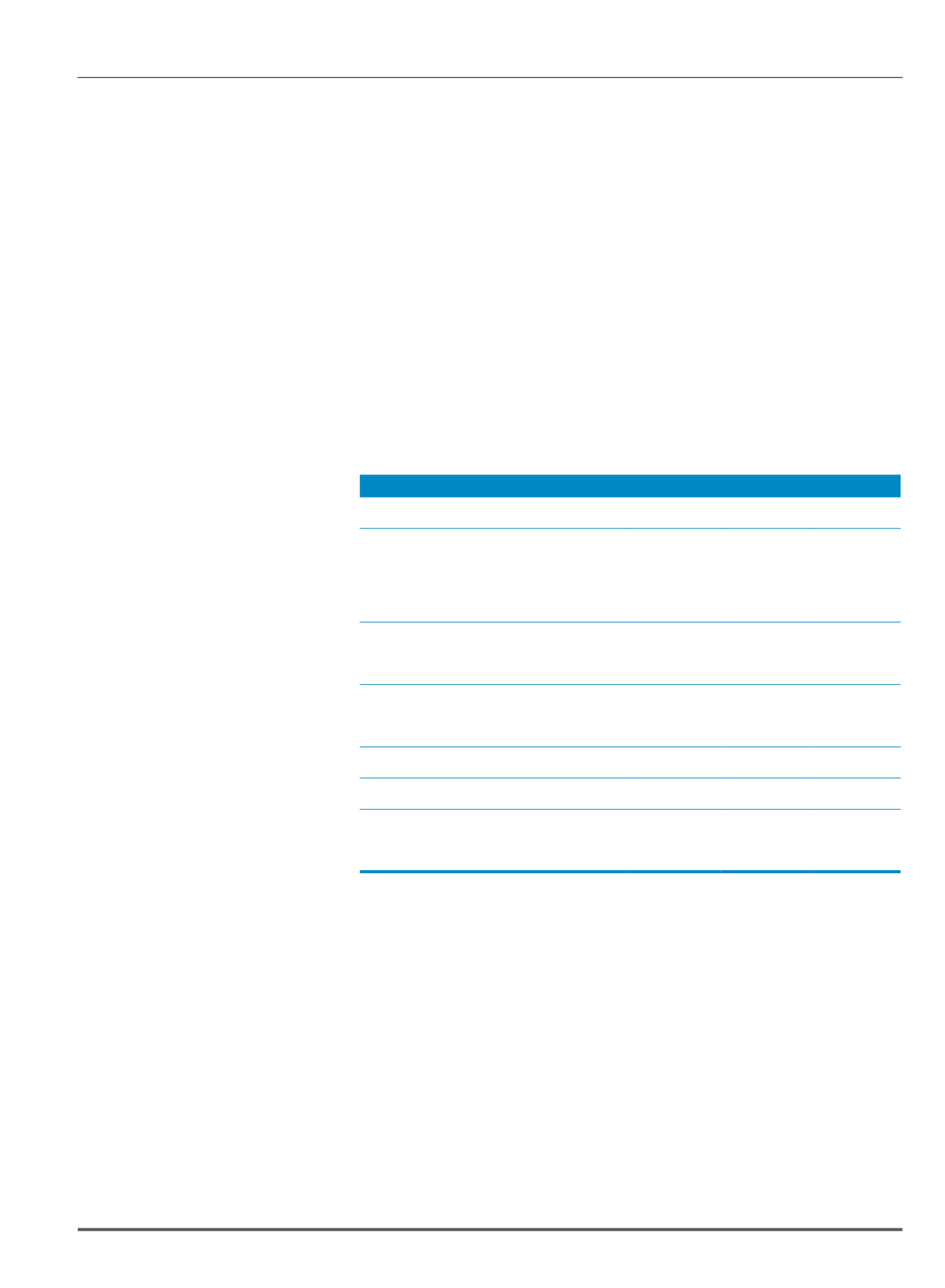

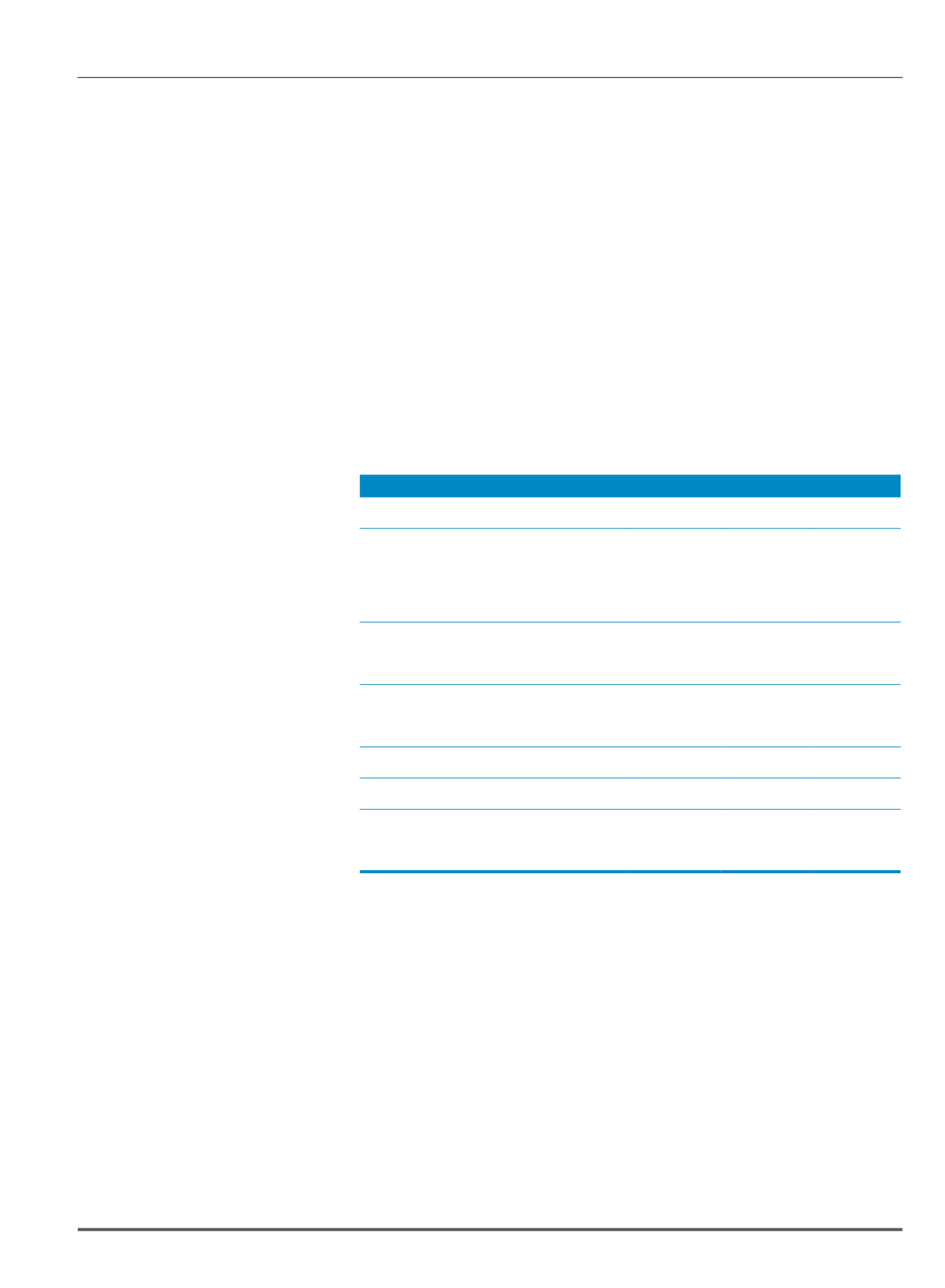

SOUND PERFORMANCE

2013 was by all accounts a year of many achievements for Bursa Malaysia. At a profit after tax and minority

interest (PATAMI) of RM173.1 million, a cost to income ratio of 48.3% and a return on equity (ROE) of 20.7%,

we delivered our best ever financial performance since 2008. Trade volumes on our Securities and Derivatives

Markets, as well as Bursa Suq Al-Sila’ (BSAS), saw double digit growth from the preceding year and provided

the uplift in PATAMI of 15% as compared to a PATAMI of RM150.6 million in 2012. Over the course of 2013,

we also strengthened our infrastructure and rolled out several new products. On top of this, we made strong

strides forward and are now near completion of the refresh of our core systems.

Financial Highlights

2013

2012

Financial Results

RM million RM million

% Change

Operating Revenue

439.8

388.5

+13%

Other Income

35.2

36.1

-3%

Operating Expenses

(229.4)

(209.2)

+10%

Profit Before Tax

245.6

215.3

+14%

Income Tax Expense

(66.2)

(58.5)

+13%

Profit After Tax

179.4

156.9

+14%

Minority Interest

(6.3)

(6.3)

-

PATAMI

173.1

150.6

+15%

Financial Ratios

Cost to Income Ratio

48.3%

49.3%

-2%

Return on Equity

20.7%

17.7%

+17%

13% Growth in Operating Revenue; Higher Trading on All Markets

Bursa Malaysia’s operating revenue grew to RM439.8 million in 2013 from RM388.5 million in 2012.

This was primarily attributable to the increase in securities, derivatives and BSAS trading revenue.

The year saw our securities trading revenue improving by 22% to RM217.3 million in 2013. Trading activity

was high as investors reacted to news on the local political arena and uncertainties in the global sphere.

There was increased participation by both domestic and foreign institutions in our marketplace with trade

value growing by 22% and 27% respectively. Meanwhile, retail participation grew by 21%.

Derivatives trading revenue improved by 11% to RM70.3 million in 2013. The growth in trades was largely

due to higher foreign interest in our market. Volume traded by foreign institutions grew by 32% in 2013, while

their participation in the market improved to 42% in 2013 from 36% in 2012.

BSAS trading revenue too rose by 70% to RM5.8 million in 2013. Domestic trades grew by 77%, while foreign

trades grew by 56%.

Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management