Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management

Bursa Malaysia • Annual Report 2013

37

By firmly embedding PFMI standards into the risk management framework,

we are reinforcing Malaysia’s reputation as a safe destination for investment

(Malaysia was ranked 4

th

in Investor Protection by the World Bank and the World

Economic Forum). This in turn will help ensure the Exchange is well positioned to

avail itself of the wealth of potential opportunities whilst meeting the challenges

of cross-border trading posed by the ASEAN Trading Link.

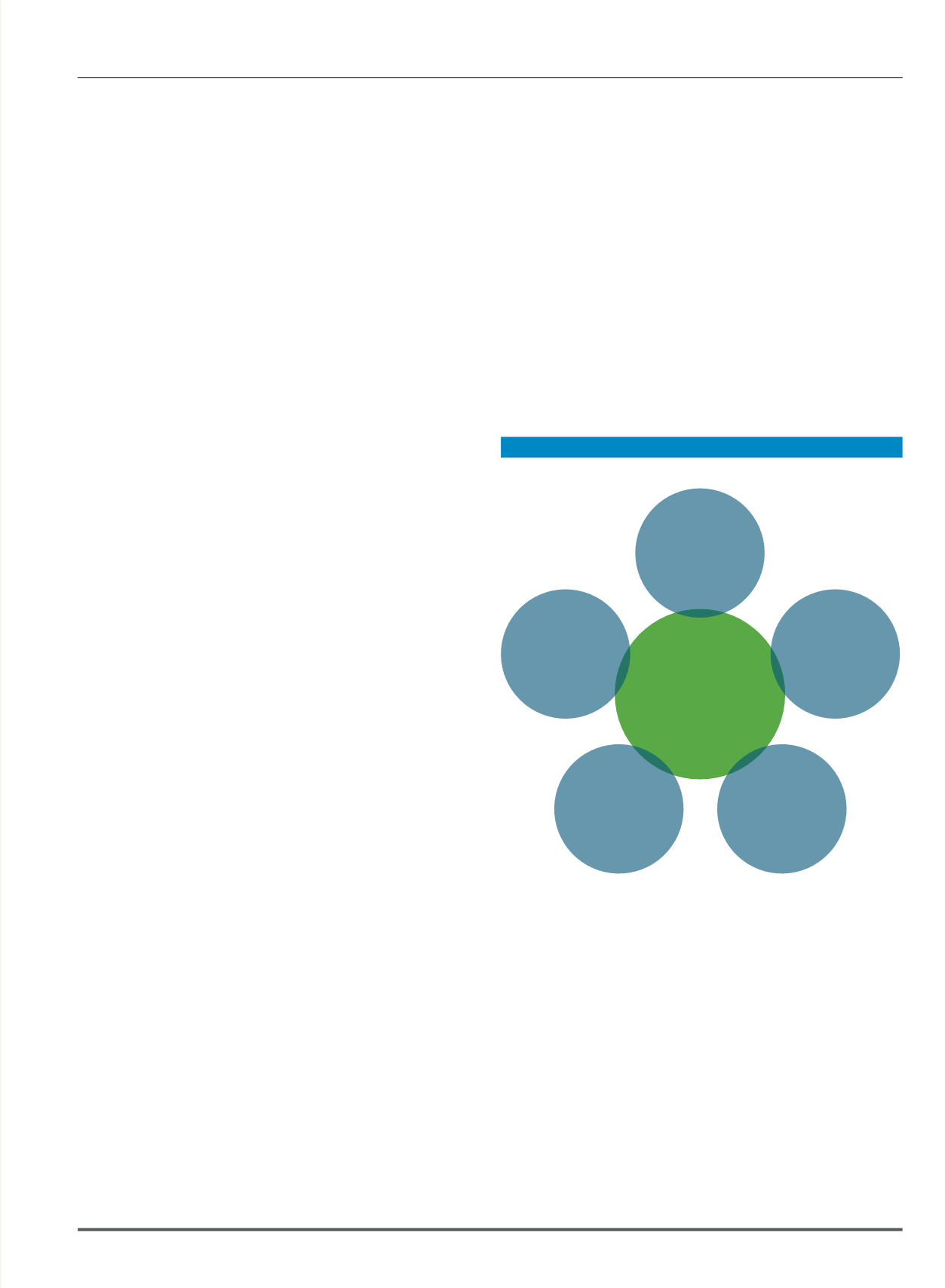

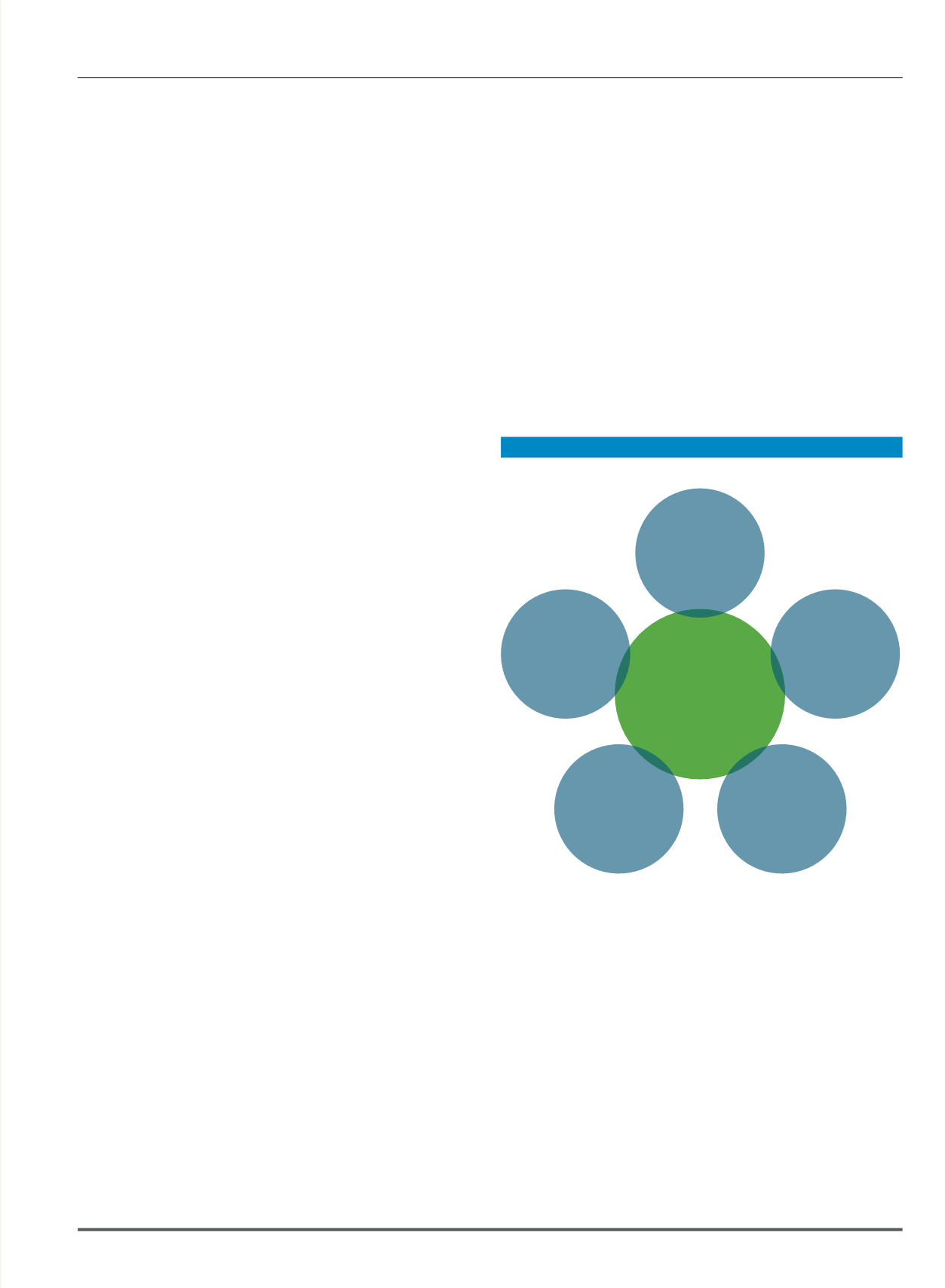

An overview of the risk management functions at Bursa Malaysia in accordance

with PFMI standards to manage systemic risk is illustrated below.

upholding market integrity

Bursa Malaysia is duty bound to ensure an orderly and fair market with regard

to the securities and derivatives contracts traded through our facilities, as well

as the securities deposited or lodged with a central depository. We are also duty-

bound to ensure orderly and efficient clearing and settlement arrangements for

any transactions in securities and derivatives contracts cleared or settled through

our facilities. In all that we undertake, we are obliged to act in the public’s best

interest, having particular regard for the need to protect investors.

In 2013, we continued to implement various measures to uphold market integrity

and ensure our markets operate in a fair, orderly and transparent manner. In the

way of enhancing our regulatory framework, we continue to adopt a five-pronged

approach that involves regulatory development, supervision, engagement,

enforcement and stakeholder education. By proactively strengthening these

areas, we are promoting efficiency, growth and transparency within our

marketplace.

ENSURING A SECURE INFRASTRUCTURE

Various policies and controls are in place within the Exchange to uphold

system security and protection of data. These include an IT Security Policy

as well as policies pertaining to email, internet and data confidentiality. Other

initiatives such as restricted physical access to confidential areas as well as

logical access for password and user-IDs too form part of our system and data

protection measures. On top of this, we exercise control over privilege ID to

access systems and change control procedures to manage data changes in

our systems.

We have also implemented a number of cyber-attack mitigation measures.

These security tools to detect and prevent cyber threats serve as added

protection against Distributed Denial of Service (DDOS) attacks and help

strengthen our Internet access vulnerability points. Their ultimate aim is to

prevent business interruptions to Bursa Malaysia’s Internet services as well as

to mitigate loss of critical data and potential downtime or reduced availability

of our critical systems following a cyber-attack.

In 2013, our securities trading system achieved 100% uptime as we switched

over to our new trading engine, BTS2 on 2 December. Similarly for the

Derivatives Market, the Globex trading system achieved 100% uptime for all

our derivatives products.

COMMITTED TO ORDERLY AND EFFICIENT CLEARING,

SETTLEMENT AND DEPOSITORY ARRANGEMENTS

We are committed to meeting the international standards of risk management

as set out in the Principles for Financial Market Infrastructures (PFMI) developed

by the International Organisation of Securities Commissions (IOSCO). These

standards ensure a robust risk management framework that reduces settlement

risk and thereby reinforces the ability of the clearing house to guarantee the

settlement of trades.

Core Function of Risk Management (RM)

Core

RM

Functions

Risk Mitigation/

Policy Development

Risk

Identification

and Assessment

including Stress

Testing

Risk Reviews

Risk Reporting

Risk Monitoring

(KRIs)

In 2013, we further enhanced our risk management capabilities by working on

several fronts to meet the rigorous international risk management standards

for clearing infrastructure set by the IOSCO, particularly in the areas of liquidity

risk framework and Clearing Guarantee Fund adequacy. The SC and the

Malaysian capital market were among the first in the world to be assessed by

the International Monetary Fund and World Bank under these stringent global

standards which included the IOSCO principles, PFMI best practices and an

extensively revised assessment methodology. The final assessment report was

published in March 2013.

The Financial Sector Assessment Programme (FSAP) reported that Bursa

Malaysia Securities Clearing had generally met all of the PFMI standards, with

the exception of Principle Six (Margining) which is still under development.

In relation to Bursa Malaysia Depository, FSAP confirmed that the latter had

observed all of the PFMI principles. Bursa Malaysia Derivatives Clearing (BMDC)

was rated to have observed 17 principles and broadly observed the other four,

while the remaining three principles were not applicable to BMDC.