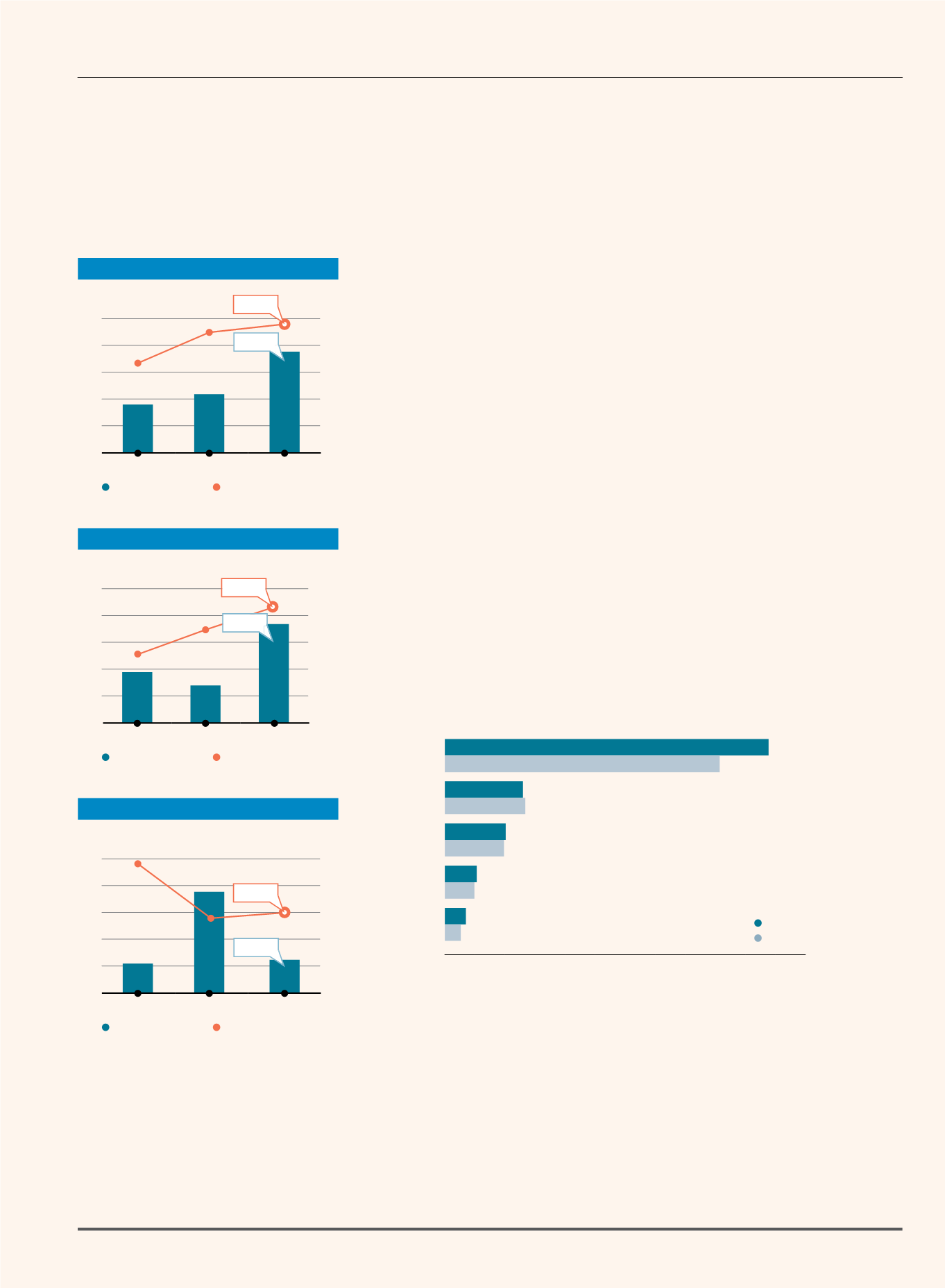

Segment Profit and Operating Margin

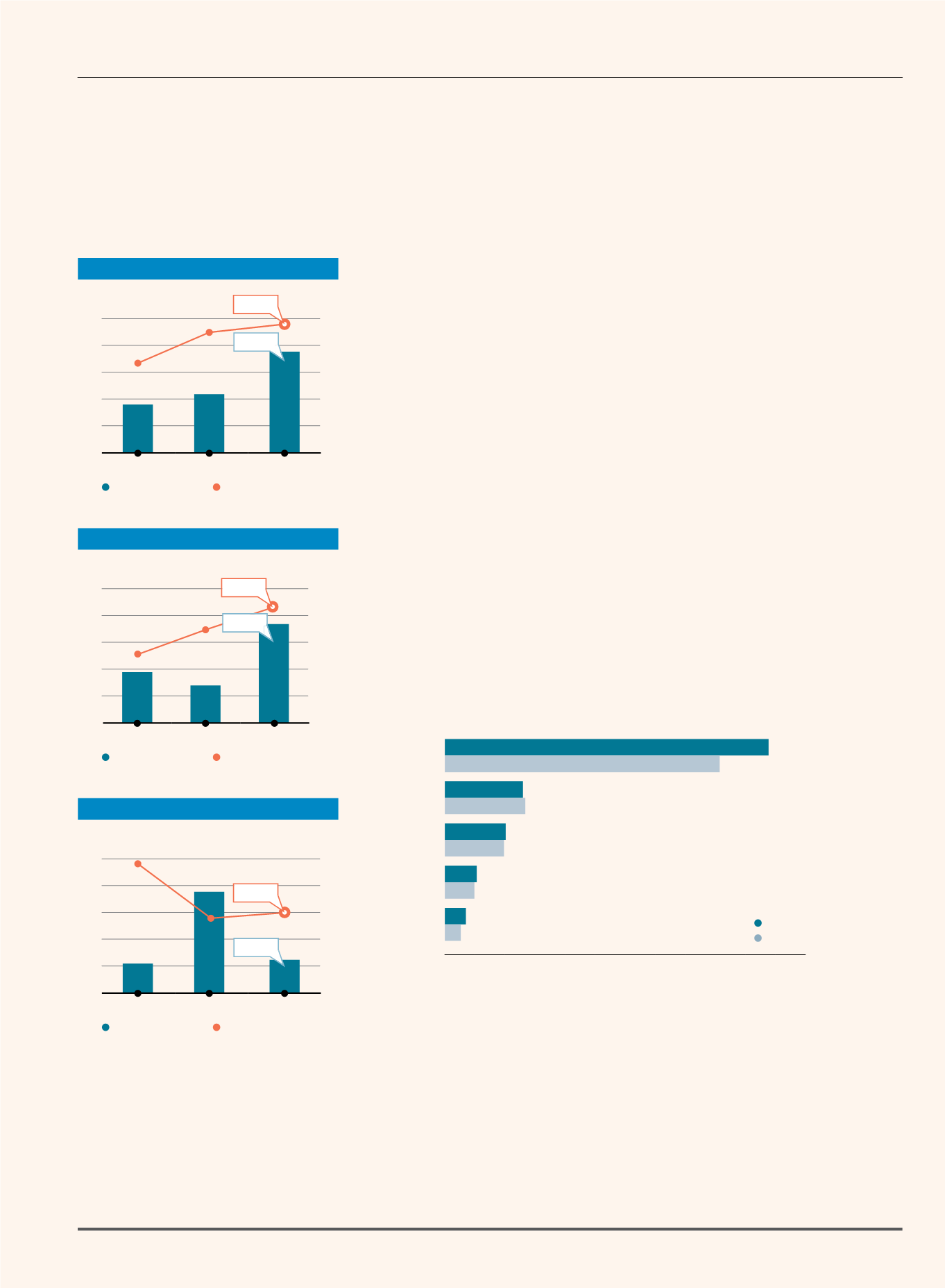

ADV and FBM KLCI

No. of New Listings and Funds Raised

2000

1800

1600

1400

1200

1000

30

24

18

12

6

0

2.4

2.2

2.0

1.8

1.6

1.4

30

24

18

12

6

0

ADV

Funds Raised

FBM KLCI

No. of New Listings

(RM billion)

(Point)

(RM billion)

2011

2012

2013

2011

2012

2013

2.1

1867

18

MARKET HIGHLIGHTS

Trading Activity on the Uptrend

The Securities Market performed admirably in 2013. Trading revenue rose 22% to RM217.3 million from

RM178.5 million. Segmental profit rose 15% to RM256.8 million from RM223.2 million in 2012, while

operating margin improved to 73.6% from 72.9% in 2012.

Total trading value rose 29% to RM527.83 billion from RM408.26 billion previously, while ADV touched

RM2.1 billion, a 28% increase over ADV of RM1.7 billion in 2012. The FBM KLCI hit an all-time high of

1,872.52 points on 30 December 2013 and closed the year at 1,866.96 points, 10.5% higher than the

preceding year end’s 1,688.95 points.

New Listings Bring a New Investment Flavour

The year saw 18 new listings on Bursa Malaysia in comparison to 17 listings in 2012. These IPOs collectively

raised funds amounting to RM8.2 billion and had a combined market capitalisation of RM36.8 billion upon

listing - well within our expectations. The largest of these were the IPOs of UMW Oil & Gas Corporation

Berhad, Westports Holdings Berhad and AirAsia X Berhad, which together raised RM5.4 billion in funds.

The year’s listings also brought a new investment flavour to the diversity of products that the Exchange offers

to meet the different needs of investors. May 2013 saw the listing of the first Malaysian stapled securities with

RM13.1 billion market capitalisation, comprising shares of KLCC Property Holdings Berhad and units of KLCC

REIT. On top of this, two Special Purpose Acquisition Companies (SPACs), namely Cliq Energy Berhad and Sona

Petroleum Berhad were listed in April and July 2013 respectively, collectively raising close to RM1 billion.

2013

2012

8.2

Bursa Malaysia • Annual Report 2013

31

SECURITIES MARKET

74

72

70

68

66

64

280

260

240

220

200

180

Segment Profit

Operating Margin

(RM million)

(%)

2011

2012

2013

256.8

73.6

217.3

178.5

51.1

51.3

37.1

36.4

19.3

18.4

14.0

11.3

Operating Revenue (RM million)

0 20 40 60 80 100 120 140 160 180 200 220

Trading

Revenue

Listing and

Issuer Services

Depository

Services

Market

Data

Member Services

and Connectivity

Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management