ISLAMIC AND ALTERNATIVE

MARKETS

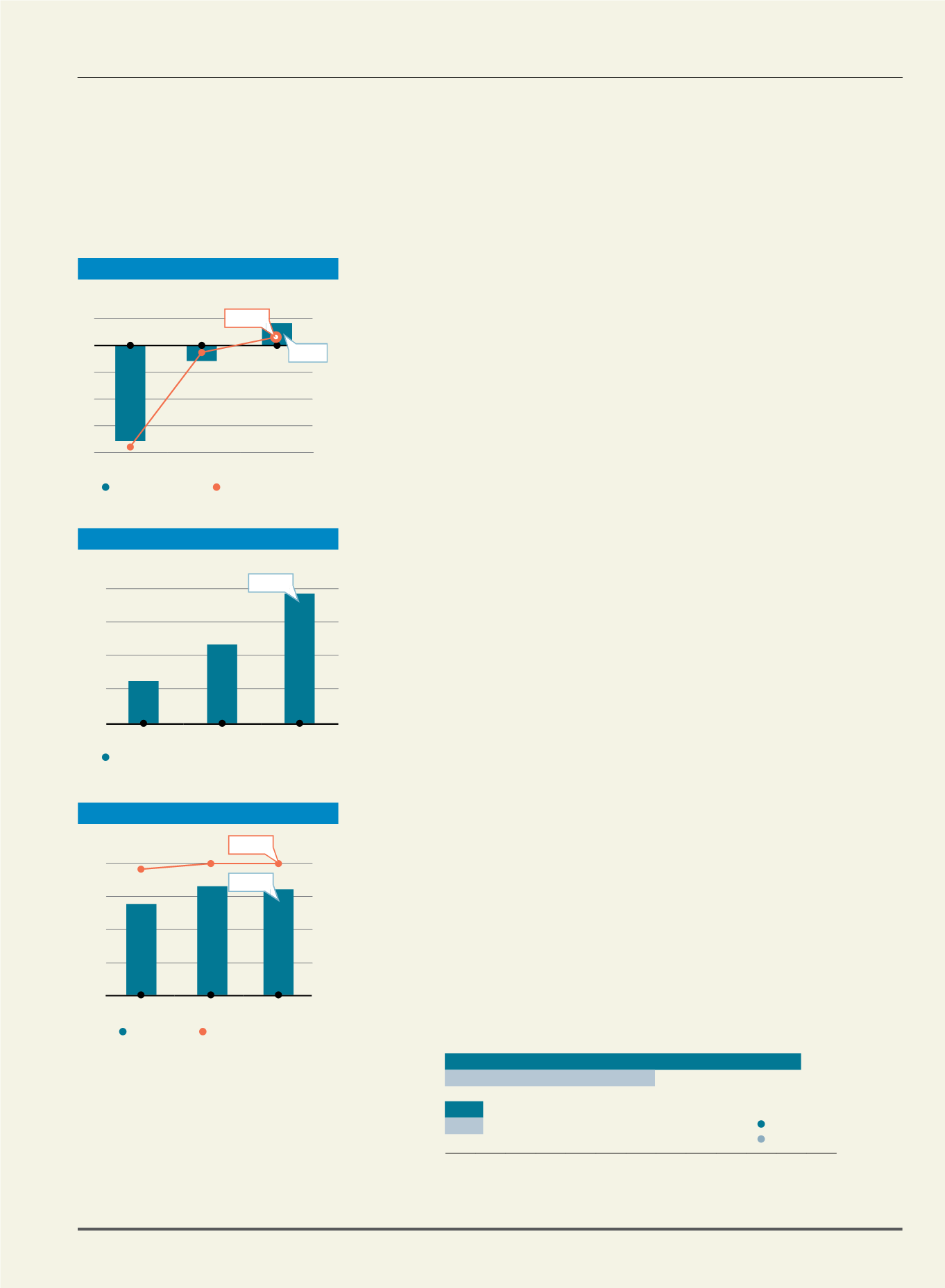

Segment Loss/Profit and Operating Margin

BSAS ADV

SUKUK

4.0

3.0

2.0

1.0

0

40

30

20

10

0

20

15

10

5

0

BSAS ADV

Sukuk Value Number of Sukuks

(RM billion)

(USD billion)

3.9

40

0

-40

-80

-120

-160

1

0

-1

-2

-3

-4

Segment Loss/Profit

Operating Margin

(RM’million)

(%)

2011

2012

2013

2011

2012

2013

0.9

13.6

2011

2012

2013

32.9

20

Bursa Malaysia • Annual Report 2013

35

MARKET HIGHLIGHTS

Islamic and Alternative Markets TURNS IN ITS FIRST YEAR OF PROFIT

The Islamic and Alternative Markets (IAM) encompasses our Bursa Suq Al-Sila’ (BSAS), Exchange Traded

Bonds and Sukuk (ETBS) and offshore financial exchange offerings. The year in review saw IAM turning in its

first year of profit primarily on the back of BSAS growth.

BSAS POSTS STRONG GROWTH

Our BSAS platform is a multi-commodity and multi-currency Shari’ah-compliant platform which currently

offers five commodities tradable in 22 currencies. In 2013, trading revenue for BSAS rose 70% to RM5.8

billion as compared to RM3.4 billion in 2012. BSAS registered a profit in 2013 marking its first profitable year.

The segment saw ADV growing by 69% to RM3.9 billion in 2013 from RM2.3 billion previously. This was

mainly attributable to increasing support from local and foreign banks using commodity Murabahah and

BSAS as a medium of trade.

On 22 July 2013, BSAS recorded its highest trade ever in a day of RM10.4 billion. BSAS recorded the highest

average ADV traded in a month since its inception when the monthly total trading value hit RM5.8 billion

in December 2013. The largest single trade was recorded when BSAS facilitated the issuance of Malakoff

Power Berhad’s Sukuk for RM5.5 billion in January 2013. In total, 32 Sukuk Murabahah were issued on the

BSAS platform in 2013, with a total of RM37.7 billion in commodities traded.

The year saw the number of Trading Participants on BSAS increasing to 78 in 2013 from 69 in 2012. This

number comprised 60 local participants and 18 foreign participants.

Innovative Sukuk Listings Reinforce Market Position

On the Islamic capital market front, we retained our leadership position as the premier sukuk listing

destination for the fifth consecutive year, with 20 programmes undertaken by 18 issuers. At end 2013, the

total sukuk outstanding value stood at USD32.9 billion. We also hosted two new listings, both being non

Ringgit issuances. The Sime Darby Global Berhad USD1.5 billion Multicurrency Sukuk Issuance Programme

listed in January 2013, was Asia’s first internationally rated multicurrency sukuk programme by an Asian

Corporate under the Shari’ah principles of Ijarah. Towards the end of the year, Bursa Malaysia welcomed

the second sukuk, the Indah Capital Ltd SGD600 million exchangeable sukuk. In July 2013, the maiden

Government Investment Issue (GII) Murabahah Sukuk for RM4.0 billion was issued by the Government of

Malaysia through Bank Negara Malaysia and facilitated by our commodity Murabahah BSAS platform.

Update on Our Offshore Financial Exchange

The Labuan International Financial Exchange (LFX) recorded three new listings in 2013, which included sukuk

and bonds issued by domestic corporate issuers. A total of USD5.2 billion was raised on the LFX. LFX’s market

capitalisation as at 31 December 2013 stood at USD23.5 billion, with a total of 32 listed instruments.

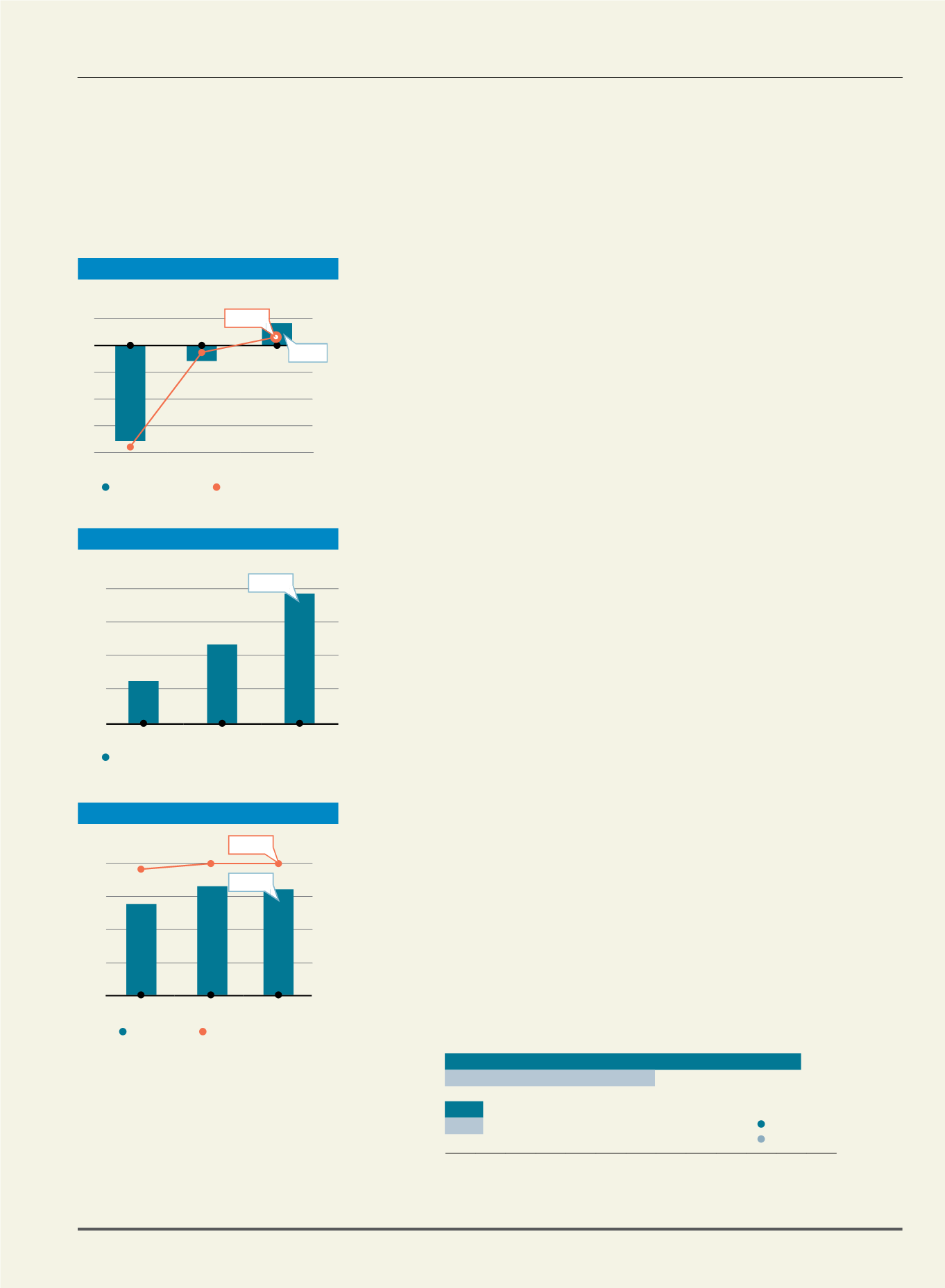

Operating Revenue (RM million)

0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0

BSAS Trading

Revenue

Others

5.8

3.4

0.6

0.5

2013

2012

Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management