2013

2012

Bursa Malaysia • Annual Report 2013

30

FINANCIAL

HIGHLIGHTS

52 sen

93%

RM173.1

MILLION

15%

48%

Dividend

PATAMI

COST TO

INCOME

RATIO

ROE

21%

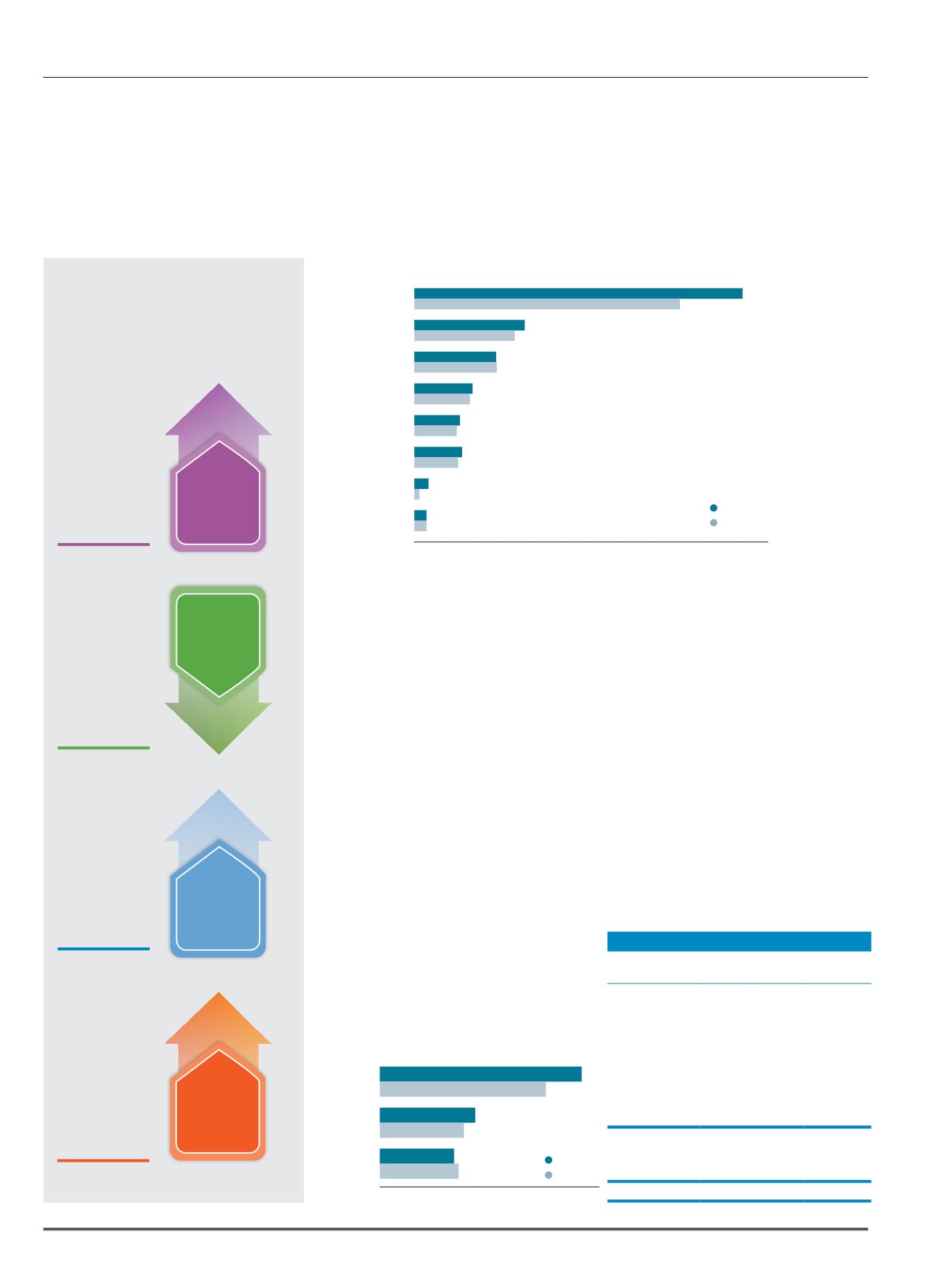

Operating Revenue (RM million)

0 20 40 60 80 100 120 140 160 180 200 220

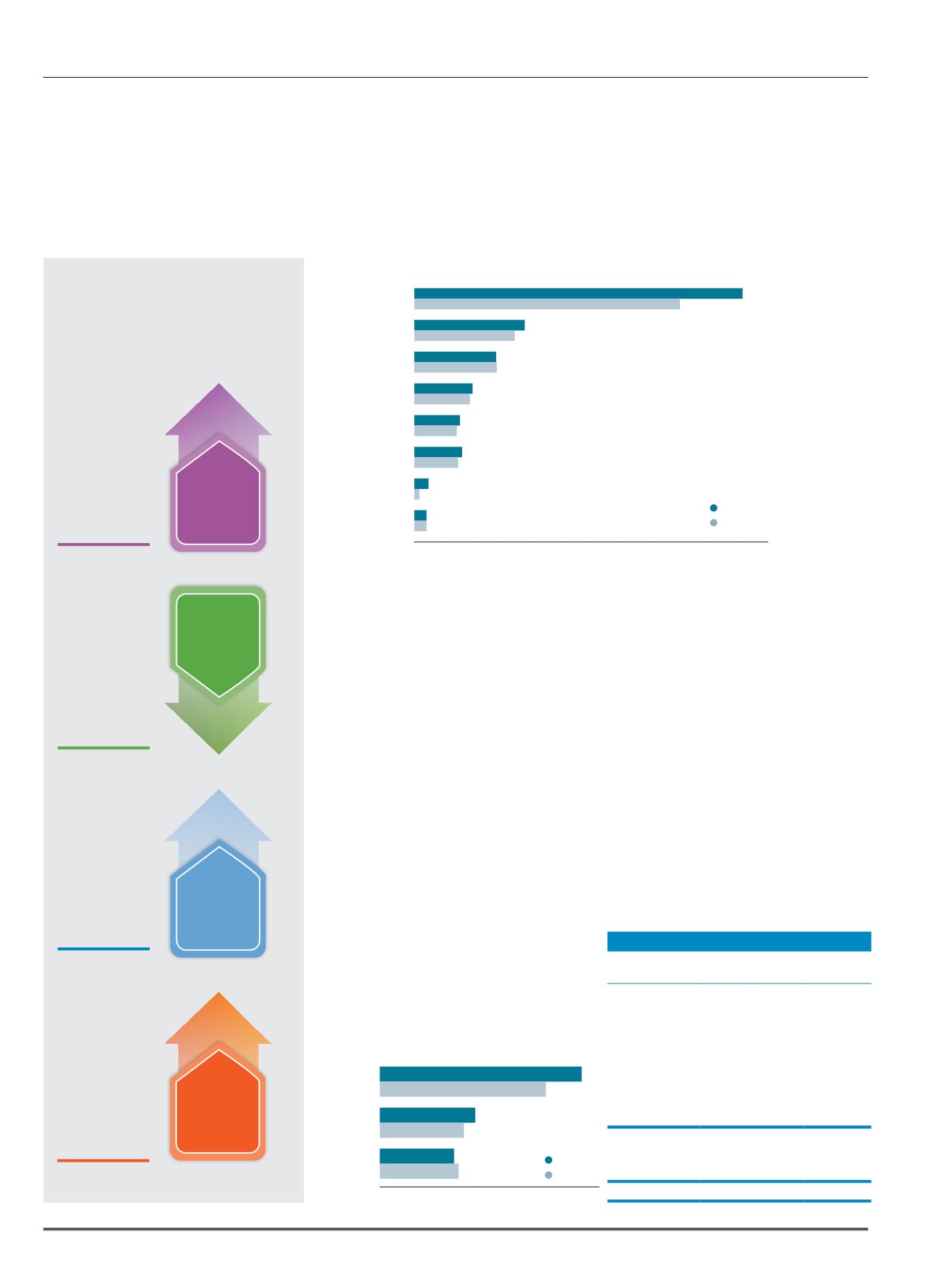

10% Growth in Operating Expenses;

Investments for the Future

The year saw our operating expenses rising to RM229.4

million from RM209.2 million in 2012. The year’s

expenditure focused on strengthening our talent pool

in order to elevate the Exchange to a HPO. To this end,

we invested in competitive remuneration packages to

retain top talent and brought in new talent to close skill

gaps. As a result, our manpower costs rose by 18% to

RM120.0 million.

Our technology costs comprise system depreciation

and maintenance, as well as Globex service fees. The

enhancements to our core systems in 2013 increased

depreciation and maintenance costs by 8% to RM45.4

million, while the higher volume of derivatives contracts

traded on Globex increased service fees by 16% to

RM15.8 million.

Technology Refresh Successfully

Completed

In 2011, we commenced the refresh of our core trading,

clearing and regulatory systems. The replacement

of our old securities trading engine with Bursa Trade

Securities 2 in December 2013 marked a significant

milestone towards the completion of the technology

refresh programme.

Returning Value to Shareholders with a

52 sen Dividend

To celebrate 2013’s commendable financial

performance and with our technology refresh

drawing to a close, we have proposed to return

98.5% of 2013’s PATAMI to our shareholders. On top

of this, we have also paid out a special dividend of

20 sen per share in August 2013. If the final dividend

of 16 sen per share is approved at the Company’s

AGM in March 2014, our shareholders will be

rewarded with a total dividend of 52 sen per share,

representing a 6.3% dividend yield.

Segmental Performance

In the year under review, our key Securities and

Derivatives Market segments made good progress,

while our Islamic and Alternative Markets started to

make positive contributions to our profit.

Segmental Profit

2013 2012

RM

million

RM

million % Change

Segmental Profit

From:

Securities Market

256.8

223.2

+15%

Derivatives Market

44.6 42.2

+6%

Islamic and

Alternative

Markets

0.9

(0.6)

+253%

Exchange Holding

3.7

5.8

-36%

Total Segmental

Profit

306.0

270.7

+13%

Overheads

(60.4)

(55.3)

+9%

Profit Before Tax

245.6 215.3

+14%

Securities

Trading Revenue

Derivatives

Trading Revenue

Listing and

Issuer Services

Depository

Services

Market Data

Member Services

and Connectivity

BSAS Trading

Revenue

Other Operating

Revenue

217.3

178.5

70.3

63.3

51.3

51.4

37.4

36.4

26.0

24.1

26.4

25.8

5.8

3.4

5.6

5.6

2013

2012

0 20 40 60 80 100 120

Manpower

Technology

Costs

Other

Costs

120.0

101.8

61.2

55.7

48.2

51.7

improved

1percentage

point

improved

3percentage

points

Operating Expenses (RM million)

Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management