ISLAMIC AND ALTERNATIVE MARKETS

Chief Executive Officer’s Message and Management Discussion and Analysis

From the Board of Directors and Senior Management

Bursa Malaysia • Annual Report 2013

36

MARKET IMPROVEMENTS

In 2013, several initiatives were implemented to bolster the infrastructure of the

IAM as follows:

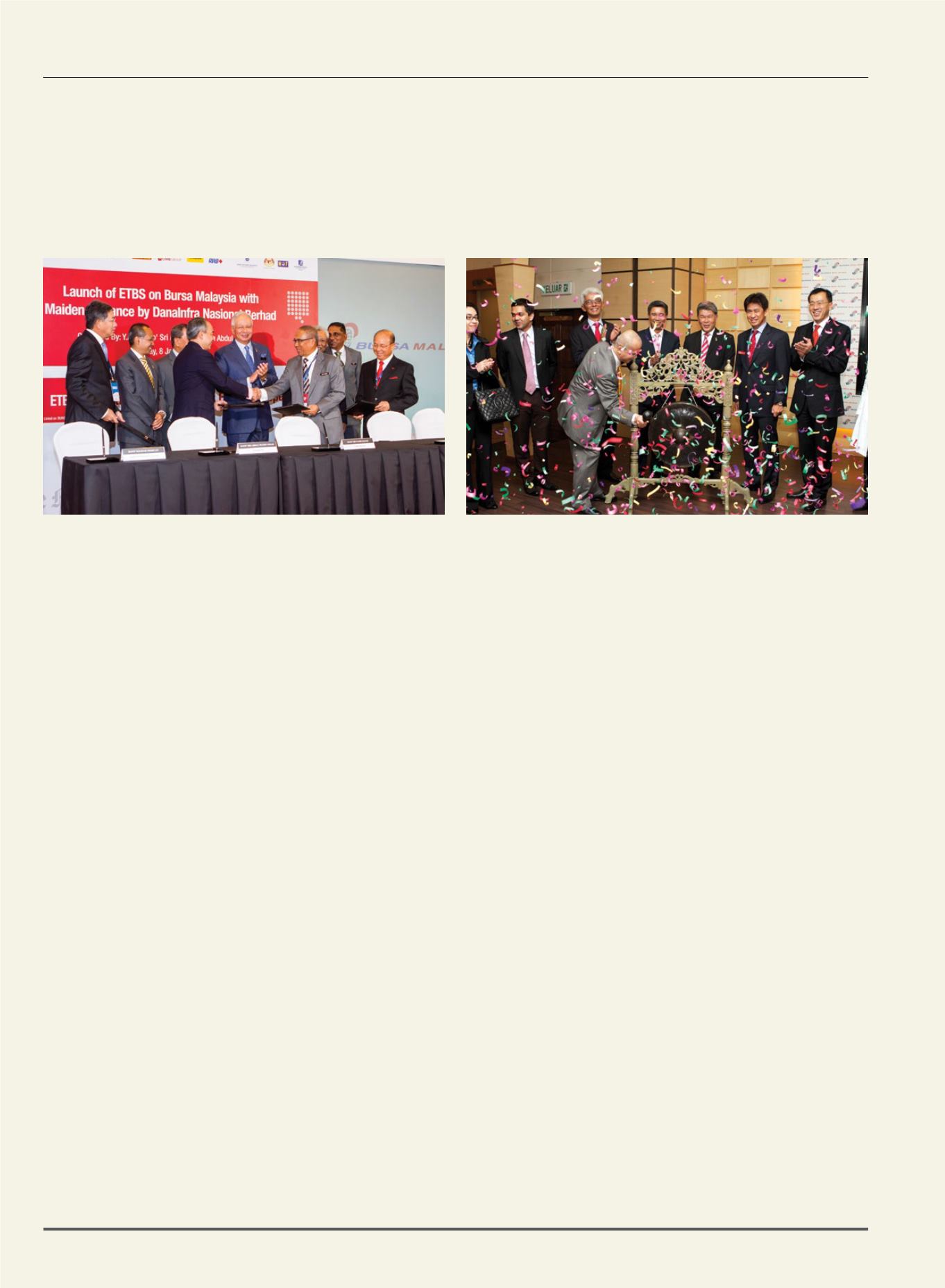

• Launch of the ETBS Asset Class

The ETBS initiative was launched by the Prime Minister of Malaysia on 8

January 2013. Conceptualised as an Entry Point Project (EPP) for the capital

market under the ETP, the ETBS aims to broaden the Exchange’s offering as

well as to promote and strengthen retail participation in the bonds/sukuk

market.

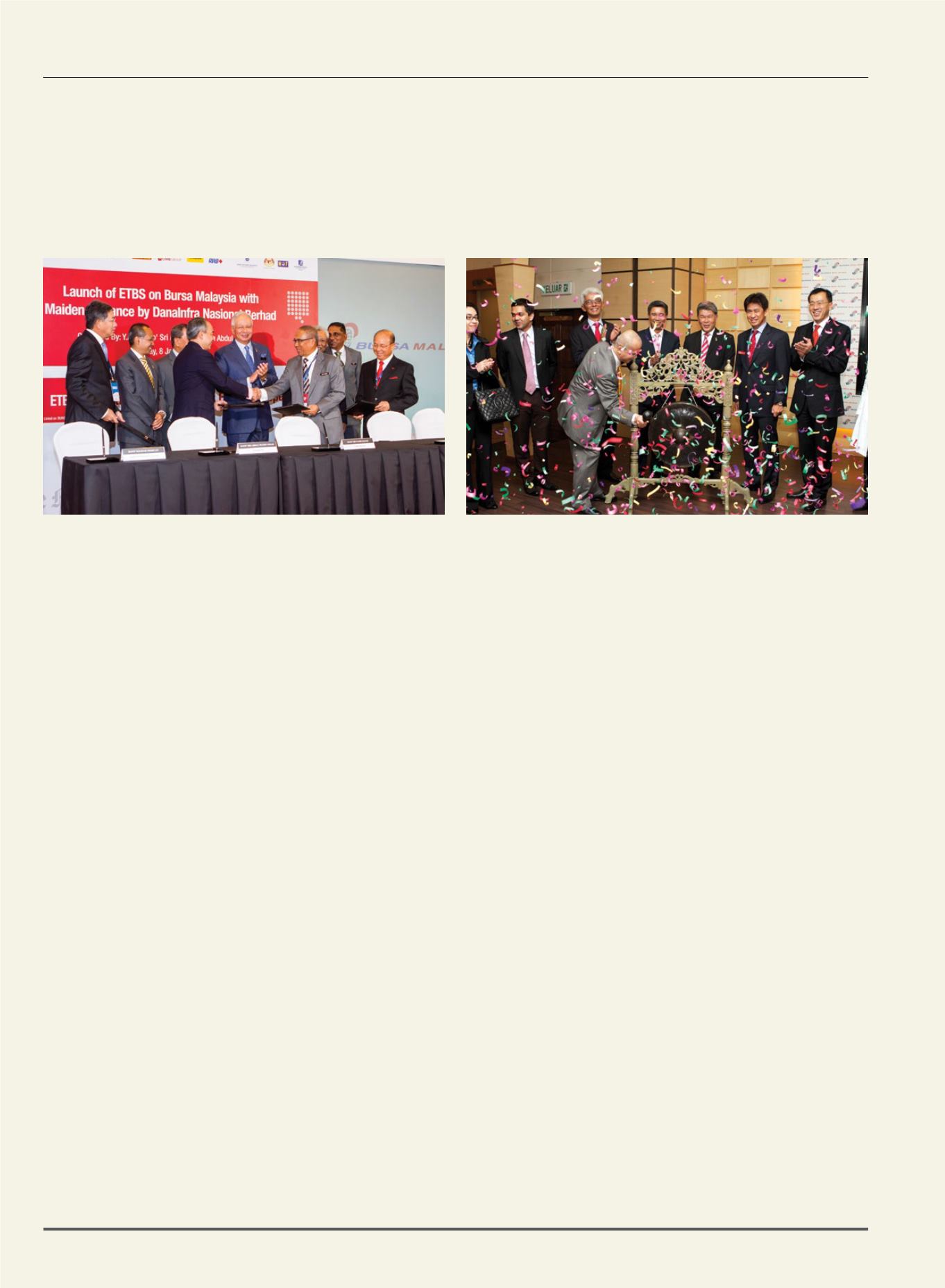

• Listing of DanaInfra Nasional Berhad (DINB) ETBS

The first Government Guaranteed DINB ETBS was listed on 8 February 2013

with an issuance size of RM300 million, a 10-year tenure and a yield of 4%

per annum. It was oversubscribed by 161%. A second ETBS for RM100 million

issued by DINB was listed on 28 November 2013. Featuring a 15-year tenure

and a yield of 4.6% per annum, it was oversubscribed by 219%.

• Revised Shari’ah Screening Methodology

The revision in Shari’ah screening methodology by Securities Commission

took effect on 29 November 2013. Aligning our Islamic securities market

with international standards, it will potentially spur a greater inflow of foreign

Islamic funds into Malaysian Shari’ah-compliant equities, thus expanding our

global reach.

MARKET ENGAGEMENT

In 2013, our IAM embarked on several initiatives to engage with investors and

promote the marketplace. We engaged with approximately 150 institutions and

15,000 retail investors. The following were some of the major events undertaken:

• Dialogue Session on Revised Shari’ah Screening Methodology (RSSM);

• Engagement with BSAS Commodity Trading Participants (CTPs);

• Participation in Invest Fair Malaysia 2013; and

• IAM participation in event and speaking engagements that reach out to

investors. These included:

- Kuala Lumpur Islamic Finance Forum 2013;

- Islamic Finance News Asia Forum 2013; and

- Palm Oil Refiners Association of Malaysia Annual Forum 2013.

Aside from the above, the following activities were initiated to increase the

number of BSAS registered participants:

• Marketing drives to encourage more trading by existing CTPs. These

initiatives included constant follow-up, specific guidance to members on

operating the BSAS system and continuous education and awareness

programmes.

• A marketing drive targeting current and potential members from MENA

Region countries. We are also exploring the potential of other regions such

as the Commonwealth of Independent States (CIS).

• Updates on BSAS operations and the support structure to facilitate the

migration of financing activities by existing and new CTPs (i.e. those

who were previously based on Bay I’nah who migrated over to Tawarruq

products based on Commodity Murabahah).

Launch of the Exchange Traded Bonds and Sukuk (ETBS)

Listing of DanaInfra (DINB) ETBS